Mindblown: a blog about philosophy.

-

Olivia Dunne Head Video: Criticism, Viral Videos, Net Worth, & More

There are tons of searches on Olivia Dunne Head Video on the Internet. Netizens are going crazy watching the viral videos of Olivia Dunne or Livvy Dunne. While a lot of fans around the globe are appreciating Olivia’s skills, some are criticizing her social media videos for being inappropriate. On the other hand, some young…

-

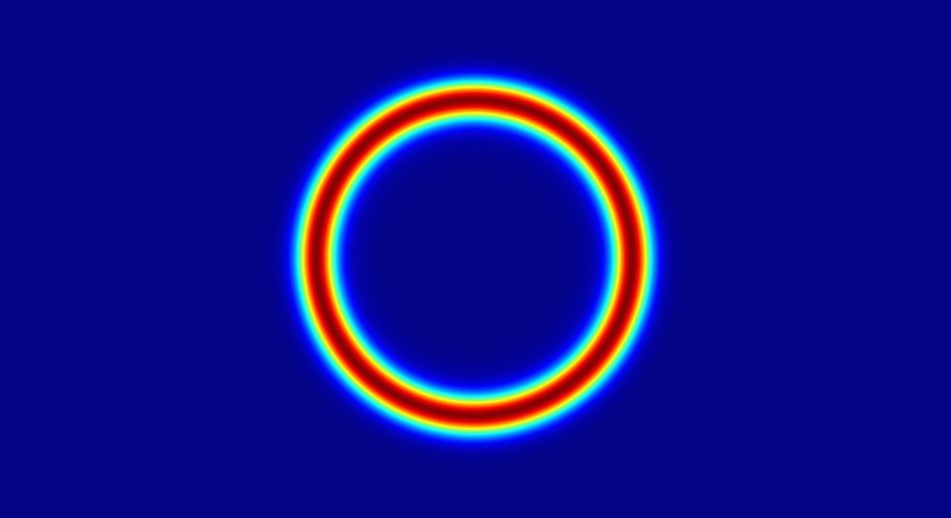

Everything You Need To Know About Diffractive Optical Elements (DOEs)

Diffractive optical elements (DOE) are unique types of optical components that are also called CGH or computer-generated holograms. These optical elements shape a laser light beam by manipulating the wave nature of the beam. This beam shaping is crucial for various modern applications that involve laser beams. Otherwise, most laser beams display a Gaussian beam…

-

DigitalNewsAlerts: Know the Ultra-Modern Way of Keeping Yourself Updated

In the current times of fast pacing world, keeping up with news updates has become the greatest challenge for individuals. With the fast growth of technology and digitalisation the popularity of newspapers, TV, and radio news has decreased significantly. The new generation is leaning more towards instant news updates from the internet and apps due…

Got any book recommendations?